How Does Investing in Real Estate Hedge Against Inflation? Part III

Manufactured home community

In two previous blog articles, I made a lot of noise about inflation.

In the first post, I talked about how to grow wealth through real estate investing in this historically unique time of low interest rates and increasing inflation. I discussed the Cantillon Effect and proposed a formula to grow your wealth.

In the second post, I discussed some specific ways to implement this wealth-building strategy. Oh, and I postulated a plan to irritate Dave Ramsey.

These two articles were posted in May 2021. A lot has happened since then. We were told that inflation was transitory. We were told that millions of chips would be installed in cars and flood the market by now. And the inflation rate for March 2022 hit 8.5%.

Clearly, a lot has changed.

While interest rates are on the rise, they remain in a historically low range. On one hand, if the proposed increases are implemented over the next 14 months, rates will still be at a historically reasonable level. On the other hand, a mortgage rate hike from (say) 3% to 5% is a 67% increase. Yikes.

We need to take this seriously. And we need to think ahead about the interest rate impact on our portfolio assets that will need to be refinanced in the next few years.

My friend and fellow commercial real estate investor, Brian Burke, pointed out that interest rate hikes have historically spanned only a few years. The rate hikes typically cause over-correction of inflation, and they are quickly dropped again. But that usually equates to a recession.

With regard to inflation, this past February I posted an article on BiggerPockets that explains why some operators might need to raise rents by 33% just to break even in a time of compressing cap rates. (Yes, you can accuse me of a clickbait title…I would have a hard time refuting that.)

But that’s not all. I want to discuss another reason we need to invest in assets that can significantly raise incomes…just to break even in our wealth-preservation and fortune-building.

You are probably already aware of this issue. But I want to bring this to center-stage to be sure you realize the significance. We’re talking about…

The OTHER Impact of Inflation

Utilizing low fixed-rate debt in an inflationary environment to purchase real estate is a great way to align yourself with the world’s great powers and to create multi-generational wealth. It sounds like a grand idea when I say it that way. But there’s a dark side to this whole discussion as well.

This dark side surrounds the consequences of NOT successfully aligning with world powers (Cantillon Effect) and NOT keeping pace with inflation.

To clarify this discussion, let’s look at this graphic from BiggerPockets’s Dave Meyer again:

From the article:

“At the top, we have two lines. The blue line represents rent growing with 2% inflation annually. The orange line shows what the value of that rent is in 2021 dollars. Remember inflation makes money less valuable, so while rent is going up 2% per year (blue), your buying power stays the same, hence the flat yellow line.

“The opposite thing happens with your mortgage payments. The amount you pay each month stays the same (blue line), but the amount that payment actually costs you in 2021 dollars declines (gray line) because inflation is lowering the value of that money over time. The gap between the light blue line and the gray line is your profit: rent in 2021 dollars minus mortgage payment in 2021 dollars. The gap gets bigger over time, which we like.”

This graphic clearly illustrates how the growing gap between fixed debt payments and increasing rent revenues creates increasing income, asset value, and wealth. The top pair of lines makes this point most clearly. But the lower pair of lines hint at a different issue that can lead to some troubling conclusions for some investors.

The lower pair of lines reminds us that inflation is not just the power that drives increasing income…it is also the power that erodes the value of that same income. And since asset value rises and falls in direct proportion to net income, inflation thus erodes the value of the wealth created by that income.

Sorry to be a party pooper. But every party needs a pooper, and that’s why they invited me.

From Father of the Bride

Now, this may all be obvious to you, but I want to drill down on this point for a moment.

There is a difference between real and nominal dollars. And not thinking about this clearly could damage your financial future. But applying this could help you create even more wealth.

Real vs. Nominal Dollars

When I hear the word “nominal,” I think of something that is not that important. An issue or sum of money that makes little difference to the outcome. But that’s not the meaning here.

Nominal can essentially mean “in name only.” So, a nominal increase in income or wealth could mean you are really not making any progress at all. Inflation is often the main culprit in this scenario.

Let’s look at an example.

My son, Jonathon, invests in large tracts of mountain land primarily for the timber. Land can be an awful investment for those who don’t know what they’re doing. Its value is often determined by a tiny buyer pool, and land often produces no income along the way.

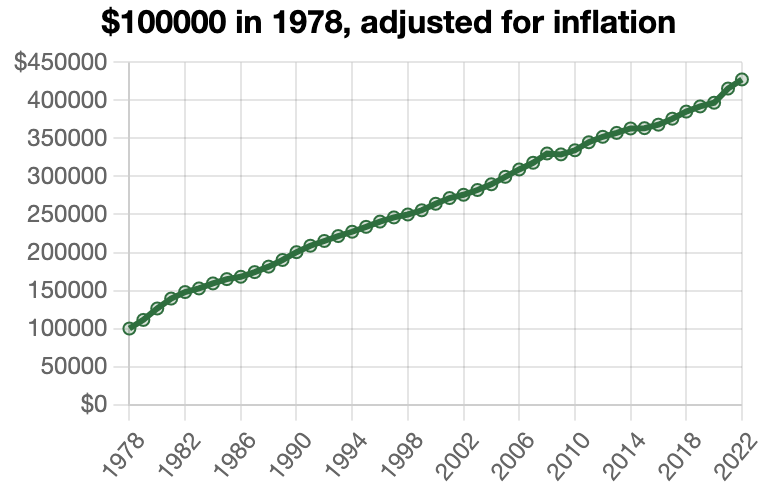

When Jonathon speaks to prospective sellers, he may hear a land owner say something like this: “I bought this piece of land in 1978 for $100,000. Now it’s worth $300,000. I’ve done pretty well tripling my money.”

Yes, he’s done pretty well. If there was no inflation.

According to the CPI Inflation Calculator, the value of a dollar has dropped by an average of 3.43% annually in that period. So the cost of goods has undergone a total price increase of 340.96% in that time period. This means our landowner would need to sell his property for $440,960 just to break even.

But that’s not really true. It’s worse than that.

Because that doesn’t take into account the landowner’s holding costs. He had to pay property taxes for years to hold this land. Oh, and don’t forget the capital gains tax on the $200,000 profit at the sale. $40,000. Yikes. So the economics went from bad to worse.

But that’s not fully true, either. It’s actually much worse than that.

The investor needs to also calculate the opportunity cost of holding this property. In other words, how much profit did the landowner leave on the table by not investing in other opportunities?

We could compare his returns to the stock market. But since this is a commercial real estate blog, I prefer to look at investments in that realm.

There are syndication opportunities galore projecting 13-18% annual returns, and some have greatly exceeded that over the past decade. But a view over four-plus decades needs to account for some downturns like that little event some of us recall from 2008. Let’s assume our landowner could have gotten a 10% compounded return on his $100,000 investment.

A 10% annually compounded ROI would have allowed the landowner to grow his $100,000 to $6,626,407 in 44 years. This would clearly beat inflation which required the $100,000 value to grow to about $440,000 to break even.

Free Download ↓

Invest with Confidence

Get your FREE Due Diligence Checklist for Passive Real Estate Investors Today!

The Implications For You As An Investor

There are many implications and I think you can draw most of them yourself. But here is a succinct way of thinking about this…

Your real ROI needs to keep pace with inflation for you to break even. And your real ROI should be calculated as your nominal ROI (the reported return) less the inflation rate less your tax rate.

What if you are getting a 13% (nominal) ROI? If you believe the 7% inflation figure, your real ROI is 13% minus 7% = 6% right now before the tax man takes a bite.

If you believe this line of reasoning, you should consider investments that don’t create a negative real ROI. So how can you do that?

There are almost infinite ways, and you need to figure that out for yourself. Wellings Capital has determined that our favorite path to creating real wealth is investing in real assets with significant unrecognized intrinsic value. Assets that are often acquired from mom-and-pop sellers.

Assets like mobile home parks, self-storage, poorly managed light industrial, and value-add multifamily. Perhaps RV parks and grocery-anchored retail will join our portfolio at some point.

Conclusion

The bottom line is this: are you investing in assets in which you have reasonable confidence will outpace the current inflation rate and the expected future inflation rates? You have a lot of choices. The stock market, cryptocurrency, NFTs, precious metals, and various types of real estate come to mind. The best thing you can do is get educated and invest in what you understand. Or you can partner with people who truly understand a particular asset class.

I am definitely biased, but I believe private commercial real estate has the best prospect of continuing to increase income and value during these unpredictable times. Private commercial real estate is a real asset, with real tenants, and tangible cash flow. Its value does not whipsaw based on a European war, a CEO scandal, a random tweet, or a bad mood on Wall Street.

I believe private commercial real estate with hidden intrinsic value, acquired from mom-and-pop owners, and upgraded by a seasoned operator, will prove to be the best hedge against inflation and will continue to prosper in an era of inflation and rising interest rates.

If you have any questions, please email us at invest@wellingscapital.com or use this link to set up a call.

This article is for educational purposes only and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision. All investments involve the risk of loss, including the loss of principal. Past performance, and any performance results reflected in this article, is not an indication of future results.